News of Typhoon Haiyan’s devastation in the Philippines has flooding – and its catastrophic impact on life and property – on everyone’s mind. Here is some information you may not know about flooding in the United States:

Since insurance companies generally excluded flood damage from coverage, our insurance has been subsidized by the Federal government for the last 40-plus years. But having taken some HUGE hits in recent years – Superstorm Sandy, Hurricane Katrina – the government is now backing off.

Changes are still being worked out, but the Biggert-Waters Reform Act of 2012 basically requires the National Flood Insurance Program (NFIP) to raise insurance rates for “some older properties” in high-risk areas to reflect true flood risk. Here’s the official wording, “Key provisions of the legislation will require the NFIP to raise rates to reflect true flood risk, make the program more financially stable, and change how Flood Insurance Rate Map (FIRM) updates impact policyholders. The changes will mean premium rate increases for some—but not all—policyholders over time.”

Even in Seattle, some homeowners will see their insurance rates go way up. You can go to www.floodsmart.gov and type in your address to see what the government currently has determined is the flood risk of your area. All the Seattle addresses I typed in came back with a “moderate-to-low” risk profile as of today, so it sounds like they haven’t really finished mapping our area (Alki? Perkins Lane?). Talk to your insurance agent for more detailed information.

We don’t yet know exactly how things will change. But it does seem that the timing will be when a home changes hands, i.e. the new homeowner may have a much larger insurance premium than the seller had. And second homes (non-primary homes) will have their rates move at 25% annual increases at policy renewal until premiums reach the full-risk rates.

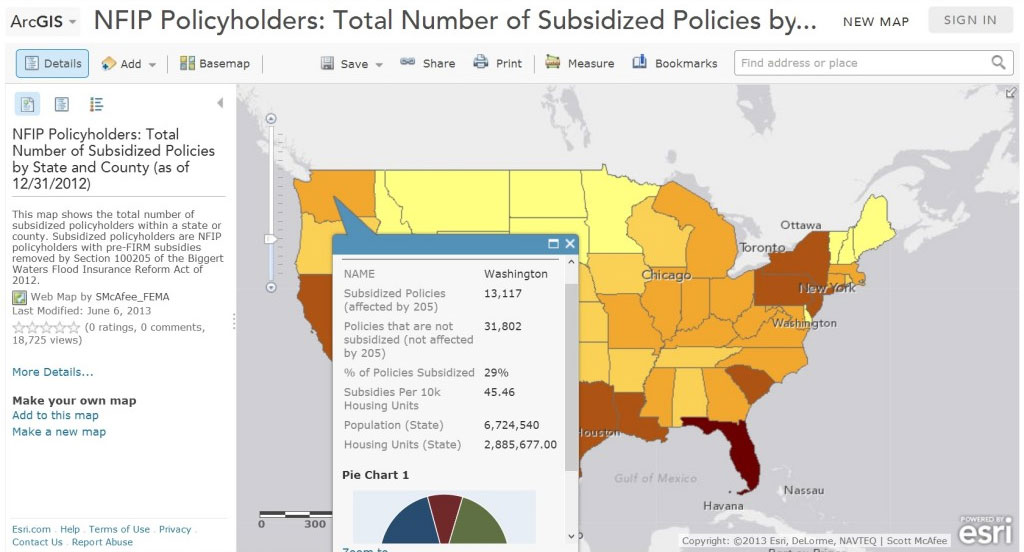

According to this NFIP map, in Washington State 29% of our flood insurance policies are subsidized, so this will in fact affect a great many people. “Many of the pre-FIRM (pre-1960’s) properties in high-risk areas do not meet current standards for construction and elevation, and they have been receiving subsidized rates that do not reflect their actual risk.”