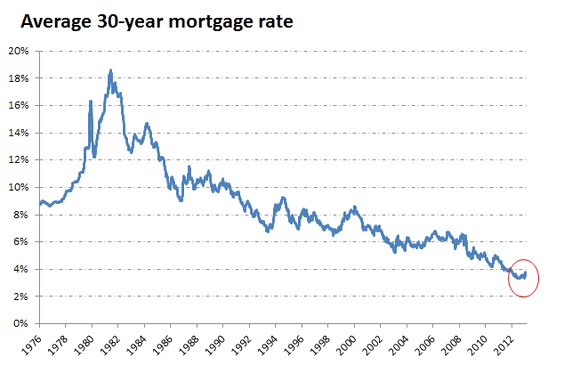

Local home prices spiked sharply last year in some neighborhoods

The Seattle Times writer Sanjay Bhatt shared some useful information last Sunday regarding home sales in King County; and I wanted to pass along some of the details about Seattle. As always real estate is totally “location specific”, so just knowing the changes in median price doesn’t inform you very well about what’s going on. Read the full article here.

Overall, we’re still about 9% below our county-wide 2007 peak in prices. But Ballard/Green Lake, for example, is only 3% below its peak (crazy popular neighborhood!) and the Queen Anne/Magnolia area was only 4% below its 2007 peak. Just about every house I’ve seen come on the market in recent weeks here has received multiple offers. And Central Seattle, which includes Capitol Hill, Madrona, Madison Park, Washington Park, etc., has actually surpassed the 2007 peak (think: lots of new construction…)

One surprise – at first glance – was that Beacon Hill, which had a below-average median price of $320,000 in 2013, actually saw a 24% increase in prices during the year! It helps to remember that these are median prices: half of the homes sold for more than that price, and half sold for less. Where the housing stock itself changes, the median price will move even though the average house might not be worth a lot more. Beacon Hill has seen lots of new construction, which sells for more, and has finally seen a big drop-off in the number of short sales and foreclosures that were plaguing it for several years, dragging the median price down. In Beacon Hill alone, distressed property sales went from 34% of the total sales in 2011 to just 15% in 2013.

The King County condo market is still way down from its 2007 peak, though it’s improving.

For the record: I don’t want to see prices spike, but I do share my clients’ pleasure at not being underwater anymore!