How To Do A Virtual Remodel

Finding love in an unlovely space

We all – real estate brokers, anyway – know how it goes: there’s a house that’s in an OK location and maybe the price is even good, but there’s something that is just so bizarre about the layout or one of the rooms that we’re stymied.

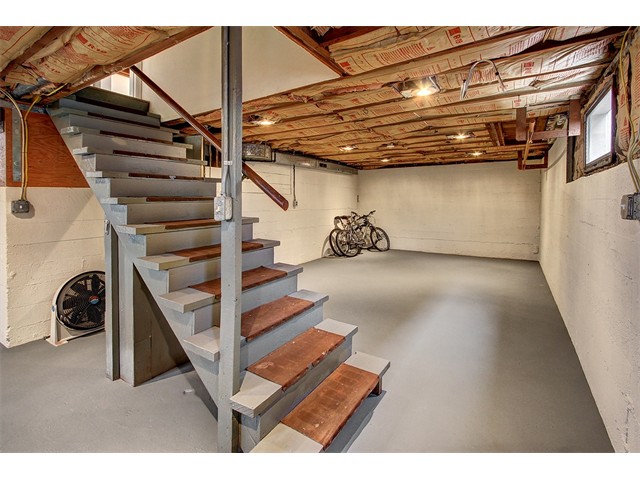

Or it’s TOO SMALL, but there’s a basement or an attic that maybe could be finished off…

We put up little signs like “Picture a 2nd bathroom here!” or “What high ceilings in the basement! Imagine the possibilities!”

Imagining a potential remodel is harder than you’d think

The fact is, though, most people actually can’t imagine exactly how something would work, what it would look like, and especially, what it would cost.

Perhaps it’s a home I will soon be trying to sell for the owner, or maybe it’s a place that would otherwise work for my buyer (if only they could imagine what to do with something).

Or maybe you’re NOT selling, or you’ve just bought a new home, but a visual on a kitchen remodel could actually set your project in motion!

Try a virtual remodel first from Seattle design company SEE3D

The Seattle company SEE3D, owned by Diane Dieterich, has developed a killer solution to this dilemma.

How it works

SEE3D is a virtual remodel company that can give you a great visual on what could be. According to SEE3D, “Renderings can give your properties a new open kitchen, a more functional floor plan, or make a dingy basement into a great family room. Help potential buyers see all the possibilities of a house to get the maximum price in the minimum time.”

They may not be able to make that remodel happen with the snap of a finger, but once you know what you want it to look like, I’m happy to refer contractors (or architects, in the case of bigger projects) to you (opens PDF) so you can start getting some bids to make your vision a reality.

Example: A Kirkland condo with a huge open upper level room

One of the interesting displays on SEE3D’s website is a collection of elevated floor plans for a Kirkland condo that had a huge open room on the upper level: How to use it? How to lay it out and define the space? “We devised 3 possible floorplans so potential buyers could imagine how functional the space could be,” says Diane.

Of course it depends on who will be living there and what their needs are for separate rooms vs. common areas. The SEE3D floor plans would be invaluable to both the seller and the buyer.

And the ideas SEE3D can share are not just for heavy lifting/wall moving type of remodels, but for design ideas in terms of updating the finishes and other surfaces in tired old properties.

A virtual remodel helps home sellers showcase the possibilities without breaking the bank

Of course, if you’re thinking of selling your house, there’s a limit to how much work you’ll want to do before putting it on the market.

But being able to have a photograph on the wall, or a design board that shows the possibilities, is a great way to pique a buyer’s interest, and won’t set you back a ton of money. Prices start at $325.00, and I’m happy to share this cost with my real estate clients. Contact me for a quick walk-through and to see how we could best take advantage of SEE3D’s services!