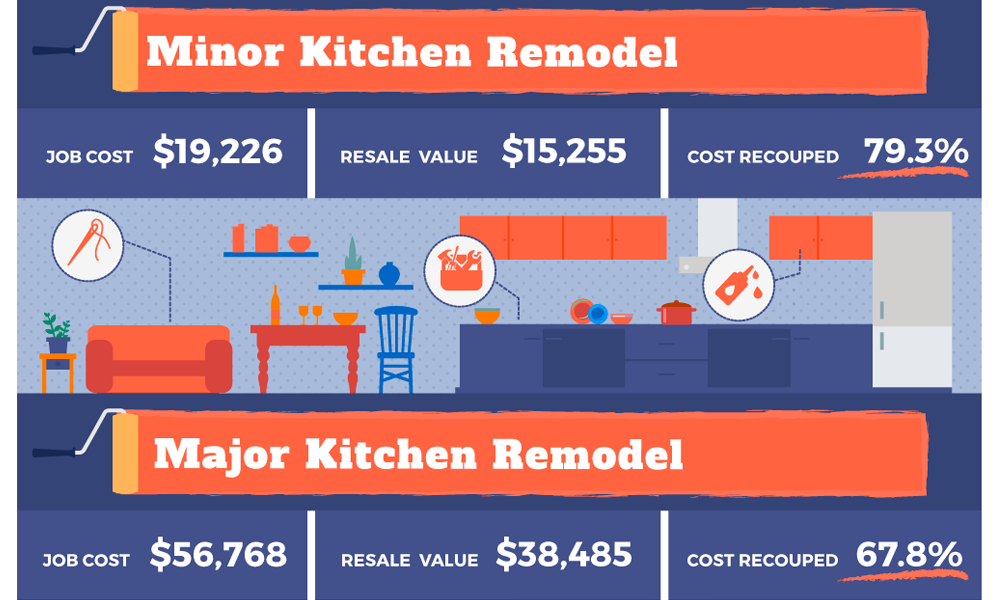

Best Remodeling Projects To Increase Your Home Value

Photo credit: Contractor Quotes

In my last blog post I told you about my newest discovery, a design company that does virtual remodels.

On the subject of remodeling, Thomas Jepsen of Contractor Quotes just sent me his great infographic on some of the best home-improvement ideas in terms of adding resale value to your home. (You can get contractor bids from companies in our area by using his website.)

The Best Way To Approach Remodeling Projects

With each project he’s got some suggestions for key points to watch out for, and I really agree with his take on this.

The idea is to approach your remodel with eyes-wide-open about what your eventual return might be. On none of these projects will you actually add 100% of the cost to the resale value of your house, but there is a wide range of what value you WILL add.

Will That Kitchen Overhaul Be Worth It? Maybe!

Nice to be aware that a minor kitchen remodel is going to come a lot closer to paying for itself than a major one will, or that simply changing out your garage door for a new, better-quality one is a great investment.

Place your bets: better to convert an attic into a bedroom? Or remodel the basement?

In Seattle, Bathrooms May Be A Better Bet

Regarding bathrooms, I have to disagree with – or at least clarify – his numbers that show a bathroom remodel is a better investment than a bathroom addition.

But in the Seattle area we have thousands of charming old houses that only have one bathroom. In my experience, as an owner you would get a better return by adding an additional bathroom, even if it’s just a toilet-and-sink half bath or a three-quarter bath with a shower.

Do What You Can With What You Have – Or Just Move

Of course if it’s really not practical or it’s cost-prohibitive to add one, by all means remodel the one you’ve got! Or move…as some of my favorite clients did recently.

Speaking Of Remodeling, Help Update My Directory Of Great Contractors

It is time to update my Fix it! Referral Directory (opens PDF), both online and the hard copy.

The majority of the contractors who have been used, loved, and then referred by my clients, friends and trusted real estate colleagues are “small business owners”. Things change for people; some of the contractors in my most recent edition are now high school teachers, or retired, or have moved to Boise. I’m ready for your updates! I’ll email or call during December, but if you think of it please reach out to me and don’t wait. Looking forward to talking with you,

Virginia Calvin

206-459-3570